This is the first in a series where we highlight some of the key issues addressed in Synchtank’s new Drowning in Data report. The report examines the challenges music publishers are facing with regards to rights, royalties and payments in the digital age.

Data is commonly referred to in the music business as “the new oil”. It is a neat analogy to a point – explaining its huge value as well as the fact that it ensures the industry machine keeps running smoothly and does not rust up. But data, just like oil, needs to be controlled when a new source is struck otherwise it becomes a blowout, pumping out in huge plumes. In the oil industry, such uncontrolled/uncontrollable gushers are referred to as “wild wells”.

The music business, in an age where billions of streaming micropayments are being generated every day, cannot afford to leave wild wells unattended and untamed.

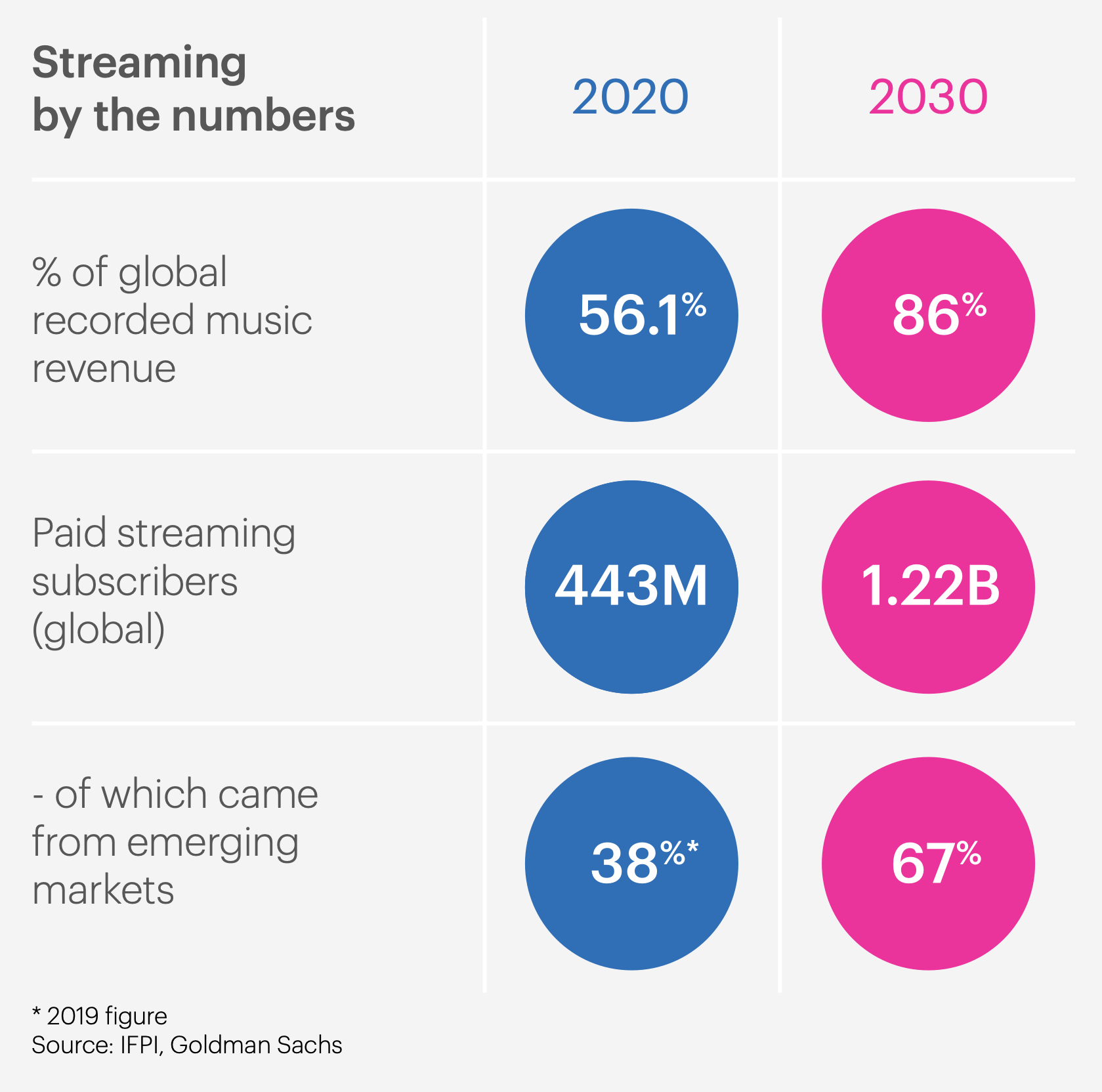

In the US alone in 2020 there were 872.6 billion audio streams of music according to MRC Data. That was an increase of 17% from 2019. Streaming made up 61.2% of record label revenues globally last year according to the IFPI’s numbers, a jump of 19.9% from 2019.

Michael Lau is the former COO and CTO at Round Hill and now president of the Association of Independent Music Publishers New York Chapter (as well as operations committee member at the Mechanical Licensing Collective). He believes there will continue to be large-scale growth into the foreseeable future.

“As music publishers and labels strive to clean up their data – as well as communicate it to other related parties, streaming platforms et cetera – this will be the icing on the cake relating to the increasing amount of data generated by the licensees,” he says. “In addition, the surge of data will be enhanced by the appetite for the additional data users are looking for such as credit details surround producer, instrumentalists and others, including writer and publisher data.”

“As music publishers and labels strive to clean up their data – as well as communicate it to other related parties, streaming platforms et cetera – this will be the icing on the cake relating to the increasing amount of data generated by the licensees.”

– Michael Lau, AIMP

Even so, an eventual plateauing will not necessarily mean the dissolving of all data management challenges.

“At some point the expansion of the major streaming services will slow as they approach saturation, but whether that slows the overall growth of data volumes remains to be seen,” suggests Matt Phipps-Taylor, chief information officer at peermusic. “It may be that the success of licensed music on social media and other new digital services becomes the next driver of data growth.”

Chart source: Drowning in Data (Synchtank)

The IFPI’s report coincided with Spotify announcing it was launching in a staggering 85 new markets, bringing the total number of countries it is available in to 178. It effectively doubled its number of active markets in one fell swoop.

That’s just one streaming service. Add in YouTube, Apple Music, SoundCloud, Amazon Music, Gaana, JioSaavn, Joox, QQ Music, Kugou Music, Kuwo Music, Melon, Anghami and Boomplay. Then add in music-adjacent platforms like TikTok/Douyin and Triller as well as gaming platforms like Twitch.

The data points keep shooting upwards.

Then there is the nascent AR and VR sector where music is used as well as the phenomenal uptick in livestreaming (on platforms like Facebook, YouTube and Instagram as well as via dedicated platforms like Driift and Dice) driven in a large part by lockdown and the need to meet both artist and audience demand for live performance.

And not to forget social media platforms where music is used like Facebook, Twitter, Instagram, NetEase and more.

Up and up they shoot.

Some of the music in certain use cases on social platforms is fully licensed (e.g. Instagram has the option of using clips of music in posts), but a significant amount is UGC. Pex, in a study from August 2020, estimated that 49% of Facebook videos in 2019 contained at least 10 seconds of music and these videos accounted for 77% of all views. Meanwhile, 58% of Instagram videos in the same year contained at least 10 seconds of music and accounted for 44% of total views. And finally music made up 30% of YouTube videos that had between 10 million and 100 million views and made up 57% of those with between 100 million to 1 billion views.

These are all uses of music and (for the most part) sources of revenue that need to be tracked, collected and accounted for.

Then there is use of music in podcasting – with Spotify’s ownership of Anchor helping to ease this process and track usage – as well as music in fitness platforms (notably Peloton) as well as non-traditional outlets like meditation apps such as Calm and Headspace.

More services launching (or expanding globally) and more markets opening up at speed present huge revenue opportunities but also existential challenges around data gathering, processing and dissecting. Even if developed markets (Europe, North America, parts of Asia such as South Korea) start to hit saturation point in terms of streaming (and subscription streaming) adoption, huge individual markets like China, India, Russia and Japan (where physical sales still have a strong market share) and entire regions – notably South America and Africa – embrace streaming, the overall global data output (and the need to handle it cleanly and quickly at increasing scale) is not slowing down any time soon.

As a sign of where we can expect things to move in the coming years, it is worth looking at recorded music revenues for some of these key regions. IFPI numbers show that Latin America has seen consecutive growth for the past six years and increased by 30.2% last year alone. Asia (excluding Japan) saw growth of 29.9%. And Africa and the Middle East saw streaming revenues alone shoot up 36.4% last year.

Meanwhile Goldman Sachs, in its Music In The Air report from May 2020, claimed that 38% of paid subscriptions came from emerging markets in 2019, forecasting that this would leap to 67% by 2030.

This is a boom time and is clearly welcome for a business that was battered by digital for a decade and a half from 2000 onwards. It is not quite a case of “be careful what you wish for”, but the shift from digital being a threat to digital being a demonstrable benefit comes with its own problems and challenges. Uncontrolled digital distribution was a catalyst for the bad times but digital data could become a trapdoor in the better times if not properly prepared for.

Handling flows of data from markets that previously were barely (if it all) on the royalties radar will see the aggregate number of data sources go through the roof.

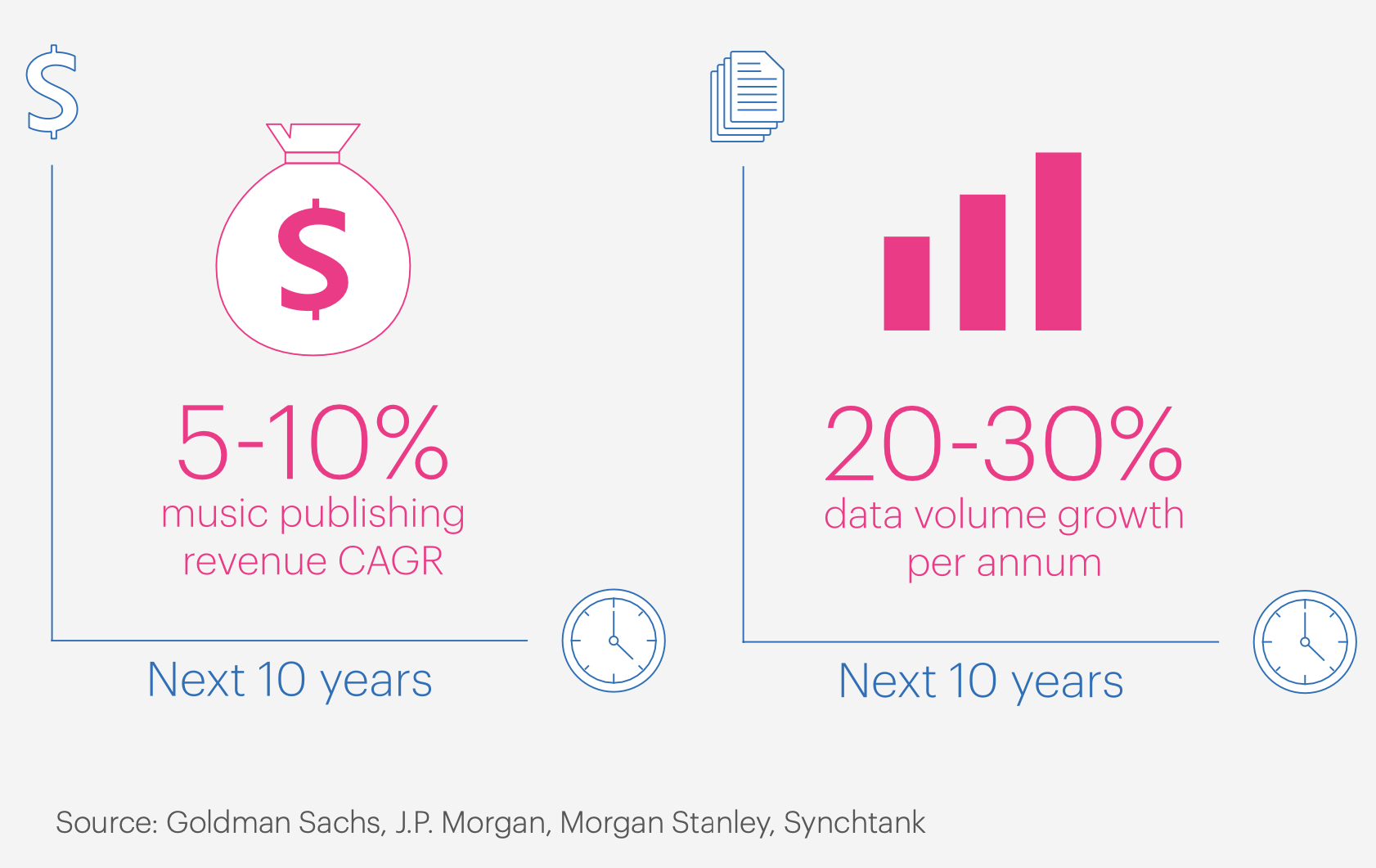

Goldman Sachs, for example, has forecast that the music streaming market will have a compound annual growth rate of 12% between 2019 to 2030.

Chart source: Drowning in Data (Synchtank)

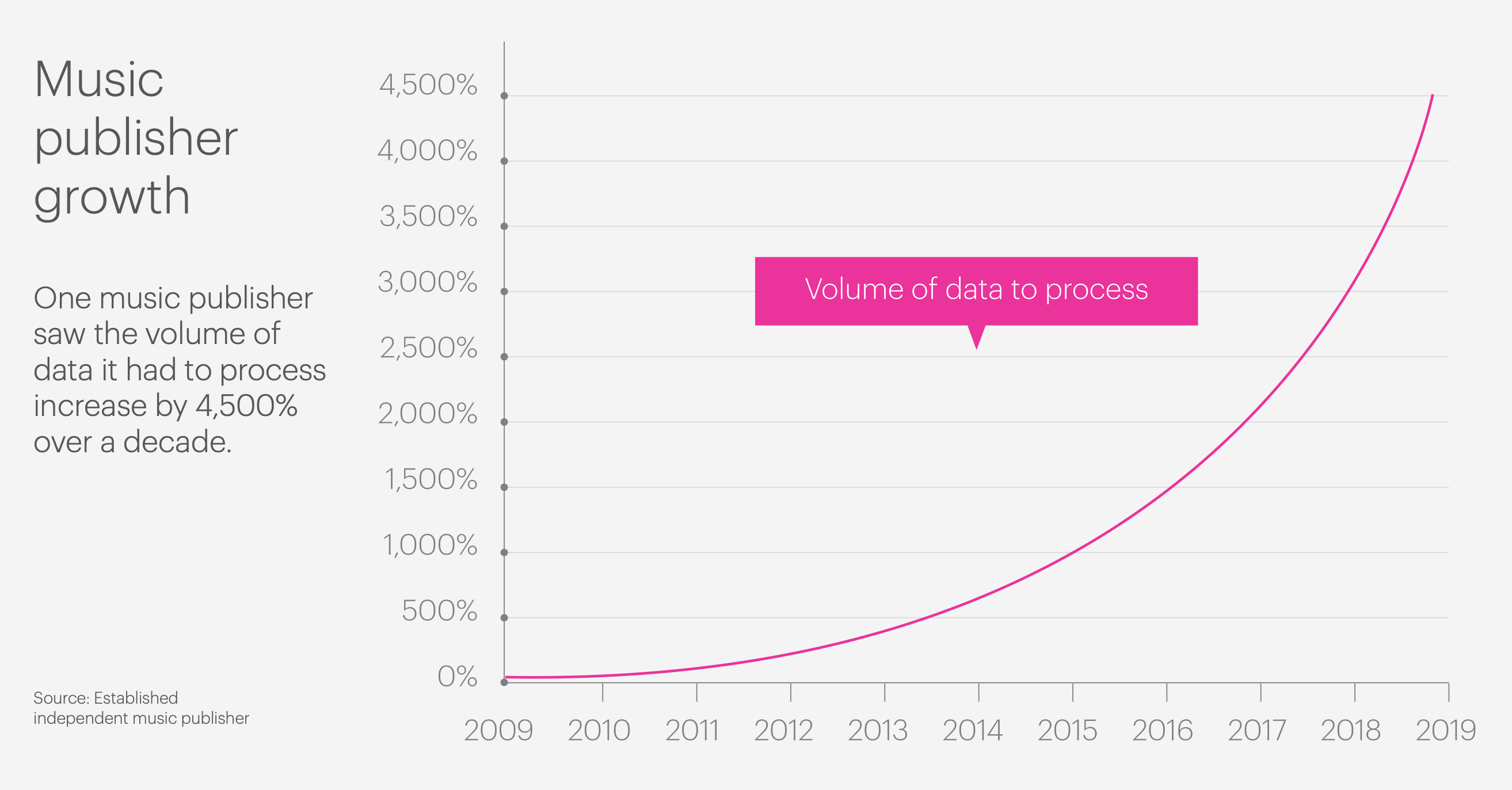

To illustrate just how much data has grown over the past decade, a leading independent music publisher told Synchtank that the volume of data it has had to process over the past decade has grown by a staggering 4,500%.

Phipps-Taylor of peermusic adds, “Over the past ten years, we’ve seen the average statement received from a revenue source – a licensee or PRO – increase in size by a factor of twenty. Over the same period, as our business has grown, the number of statements we receive has increased threefold. In total, we are now processing sixty times more data than we did a decade ago.”

“In total, we are now processing sixty times more data than we did a decade ago.”

– Matt Phipps-Taylor, peermusic

The lines of data to be processed every year are rising sharply and this acceleration is something rightsowners need to stay on top of – somewhat akin to running up a down escalator as it steadily increases in speed.

The processing systems rightsholders have in place currently are going to have to keep growing and expanding – handling more data lines from more data sources more quickly – to keep on top of this accelerated growth.

Things here can become more fragmented and convoluted – and this brings with it new difficulties and concerns. “The challenge with the degree of fragmentation and complexity we are increasingly seeing is the associated reliance on very efficient exchange and processing of data between many parties to enable the smooth and timely flow of royalties,” says Phipps-Taylor. “The ‘data plumbing’ in the music industry is notoriously leaky, so it is always a worry to us that errors and gaps in data will arise and not be spotted or resolved, and some of our clients’ royalties will be missed or delayed.”

Lau feels that accuracy of payment data will be a growing worry here and that safeguards need to be put in place. “As we are in a time, especially in the US, where the volume of rights are transferring at a rate previously unknown in the industry, I’m really concerned about the bandwidth at the organisations we entrust our rights management with,” he says. “Lack of proper bandwidth compounds the accuracy and human error is already inherent in the process. We will have to be diligent in double-checking to a greater degree.”

Synchtank forecasts the volume of data here from music streaming services, as well as from other digital sources, is set to grow at a rate of 20-30% (or possibly more) every year for the next decade.

Chart source: Drowning in Data (Synchtank)

This quantitative spike in data comes with serious qualitative considerations – namely that data systems within all kinds of music and rights companies cannot afford to slip behind the ever-growing curve. They do not just have to be fit for purpose today – they need to be sure today that they will be fit for purpose five, 10, 15 years down the line.

Major companies are more financially and organisationally able to invest to build and maintain the best data-processing infrastructure, but smaller companies could be seriously disadvantaged here.

“It is not economically feasible to be processing these volumes of data manually – and that undoubtedly presents a challenge for smaller companies without sophisticated technology systems.”

– Matt Phipps-Taylor, peermusic

“The volume and complexity of data to process has never been greater than it is now – but the average value of each individual line of data has never been lower!” warns Phipps-Taylor. “So it is not economically feasible to be processing these volumes of data manually – and that undoubtedly presents a challenge for smaller companies without sophisticated technology systems. The availability of low-cost and highly scalable cloud-based technology does offer solutions, but transitioning to these technologies is not always straightforward – they represent a fundamentally different way of designing data processing systems and necessitate a different set of skills – and companies that don’t start exploring and investing in this area quickly enough may find themselves overtaken by the data volumes.”

For Lau, the challenges here – as data increases in volume and complexity – are many and varied. Scalability is, he believes, a huge issue for both vendors and platform developers who have typically been “reactive and slow to adopt solutions” as this sector has exploded.

“Our industry needs agile systems,” he says. “Many of these systems that are being asked to handle this new volume – and additional details in the metadata – are struggling. To be honest, part of it is the inherent old code, but a greater part is the UX implementation. It’s not about the code; it’s about the speed and efficiency and thoughtfulness of the process that, in my opinion, will be the key in how well the industry can manage and succeed. We need a lot of out-of-the-box thinking on this.”

“Our industry needs agile systems. Many of these systems that are being asked to handle this new volume – and additional details in the metadata – are struggling.”

– Michael Lau, AIMP

If data is the new oil, that comes with a tacit understanding that fresh wells are being drilled all the time while the output of existing wells steadily increases. Harnessing not just an uptick in the number of wells but also an uptick in the output of each well is essential.

If that is not done, it is not just a wasted opportunity, it also leaves behind a terrible mess.

For more insight download Synchtank’s free Drowning in Data report here.

3 comments

[…] ▶ Drowning in data: a wake-up call for the music industry? […]

[…] The music industry is drowning in data. What should be done with all this information? Discuss. […]

[…] Drowning in data: A wake-up call for the music industry […]